Introduction

2024FY saw a reduction in profitability (return on assets managed, ROAM) across our producer business groups and private clients, falling from 2.6% in 2023 to 1.2% in 2024. The reduction in profitability was caused by a reduction in profit (earnings before interest and tax, EBIT) and an increase in asset values (yield compression).

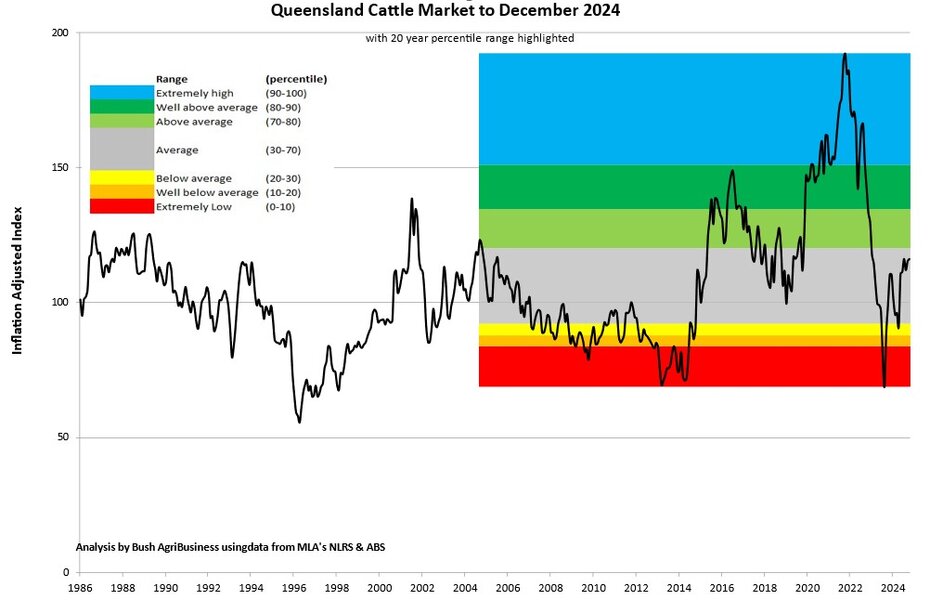

The reduction in profit was driven primarily by drop in beef prices; in 2024FY beef prices averaged the 35th percentile of prices over the last 20years, compared to the 77th percentile in 2023FY and the 97th percentile in 2022FY. Currently the market is at the 65th percentile of 20year prices.

The fall in beef prices was offset slightly by a reduction in cost of production. The reduced cost of production is the result of an increase in kilograms produced AE, not lower costs. The increase in productivity was seen across all enterprise types.

The increase in land values in recent years (averaging over 15% in 2024 and greater than 15% for the last 4 years) has been fantastic for balance sheets and building wealth, but has resulted in reduced profitability (yield compression) and will necessitate a rethink on what debt levels beef businesses can afford. The effect of increasing land values can be seen in the changing relativity in herd profits (EBIT/AE) and business profitability (ROAM) over time (i.e. herd profits in 2021-3 were equivalent to or higher than 2016-17, but resulted in lower ROAM because of the increase in the land value).

All enterprise types saw a reduction in profitability in 2024, although the growing (i.e. dry stock only) enterprises saw the biggest reduction in profits during the year. Usually growing enterprises achieve higher herd profits than breeding enterprises, a function of being located on better country and through growing herd being more productive. In 2024 though, growing herd profits were lower than breeding, due to the cattle market and seasonal conditions.

The EBIT/AE of Top 25% enterprises within the client group was nearly 3 times that of the average, although the relativity has fallen since 2023. The factors which separate the top performers from the average are consistent with other datasets and other time frames. Generally, the top performers;

- have more productive herds, generate more income per animal unit,

- have better targeted and lower enterprise expenses

- have lower overheads, resulting from better labour efficiency

This reiterates that focussing on these fundamentals will result in the best long-term returns for your business, through the full cycle of seasons, cattle prices and interest rates.

If you would like a better understanding of how your beef business is performing, what it’s strengths are, what the areas for improvement are and how it compares to the best in the industry, then see more information on our website or give us a call.